Form IRS 8379 Fill Online, Printable, Fillable 2021-2026

What is the IRS Form 8379?

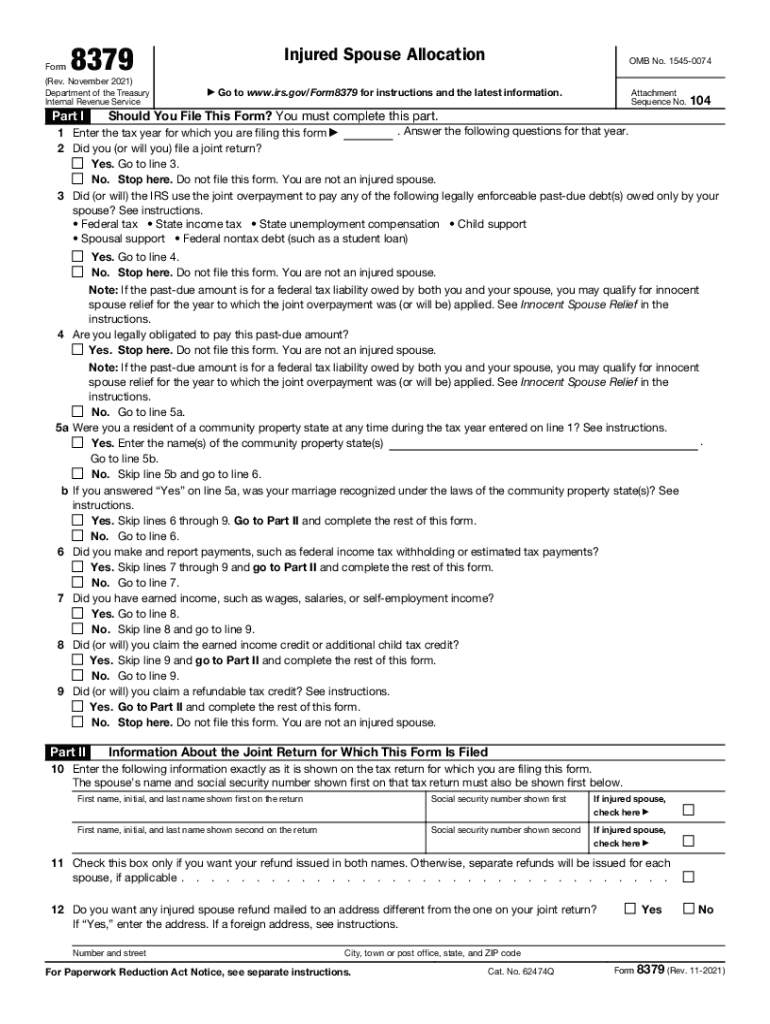

The IRS Form 8379, also known as the injured spouse form, is a tax document used by individuals who are married and filing jointly. This form allows a spouse to claim their share of a tax refund that may be withheld due to the other spouse's debts, such as unpaid child support or federal student loans. By completing the IRS 8379, the injured spouse can ensure that their portion of the refund is protected and returned to them.

The form is essential for individuals who want to safeguard their tax refund from being applied to their spouse's financial obligations. Understanding the purpose of this form is crucial for anyone in a situation where their tax refund might be compromised due to their partner's debts.

Steps to Complete the IRS Form 8379

Completing the IRS Form 8379 involves several key steps to ensure accuracy and compliance. Here is a straightforward guide:

- Download the IRS Form 8379 from the IRS website or obtain a printable version.

- Fill in your personal information, including your name, Social Security number, and address.

- Provide your spouse's information in the designated section.

- Indicate the tax year for which you are filing the form.

- Detail the amount of the expected refund and how it should be allocated between you and your spouse.

- Sign and date the form to validate your submission.

After completing these steps, you can submit the form either electronically or by mail, depending on your filing method.

Eligibility Criteria for IRS Form 8379

To qualify for filing IRS Form 8379, certain eligibility criteria must be met:

- You must be married and filing a joint tax return.

- Your spouse must have a debt that could lead to the withholding of your tax refund.

- You must have earned income that is subject to tax.

- Your tax refund must be at risk of being applied to your spouse's debts.

Meeting these criteria is essential for successfully claiming your portion of the tax refund through the injured spouse form.

Legal Use of the IRS Form 8379

The IRS Form 8379 is legally recognized as a means for individuals to protect their tax refunds from being seized due to a spouse's financial obligations. To ensure the form's legal validity, it must be completed accurately and submitted within the appropriate timeframe. Compliance with IRS guidelines is crucial for the form to be accepted and processed correctly.

Using the form correctly can prevent potential financial hardships that arise when tax refunds are withheld. It is important to keep records of the submission and any correspondence with the IRS regarding the form.

Form Submission Methods for IRS Form 8379

The IRS Form 8379 can be submitted through various methods, depending on how you file your taxes:

- Electronically: If you file your tax return electronically, you can include Form 8379 as part of your e-filing process.

- By Mail: If you prefer to file a paper return, you can print the completed form and mail it along with your tax return to the appropriate IRS address.

- In-Person: You may also choose to deliver your form in person at a local IRS office, although this option is less common.

Each method has its own processing times, so it is advisable to choose the one that best suits your needs and timeline.

Key Elements of the IRS Form 8379

Understanding the key elements of the IRS Form 8379 is vital for ensuring a smooth filing process. Important components of the form include:

- Personal Information: Accurate details about both spouses are required.

- Tax Year: Specify the tax year for which you are claiming the refund.

- Refund Allocation: Clearly indicate how the refund should be divided.

- Signature: Both spouses must sign the form to validate it.

These elements are crucial for the IRS to process the form correctly and ensure that the injured spouse receives their rightful portion of the tax refund.

Quick guide on how to complete 2016 2021 form irs 8379 fill online printable fillable

Effortlessly prepare Form IRS 8379 Fill Online, Printable, Fillable on any device

The management of online documents has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without any holdups. Handle Form IRS 8379 Fill Online, Printable, Fillable on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Form IRS 8379 Fill Online, Printable, Fillable without hassle

- Locate Form IRS 8379 Fill Online, Printable, Fillable and select Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Alter and eSign Form IRS 8379 Fill Online, Printable, Fillable and ensure outstanding communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 2021 form irs 8379 fill online printable fillable

Create this form in 5 minutes!

How to create an eSignature for the 2016 2021 form irs 8379 fill online printable fillable

How to generate an electronic signature for your PDF in the online mode

How to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the IRS injured spouse form 8379 and why do I need it?

The IRS injured spouse form 8379 is a tax form used to claim your share of a joint tax refund if your spouse has debts owed to the IRS or other government agencies. By filing this form, you can ensure that your share of the refund is protected from being applied to your spouse's debts, allowing you to receive the funds you are entitled to.

-

How can airSlate SignNow help me with the IRS injured spouse 8379 form?

airSlate SignNow provides an easy-to-use platform to electronically sign and send the IRS injured spouse form 8379 securely. Our solution simplifies the process, ensuring that your form is submitted quickly and efficiently without the hassles of paper documents.

-

What are the benefits of using airSlate SignNow for IRS injured spouse 8379 submissions?

Using airSlate SignNow for your IRS injured spouse 8379 submissions offers numerous benefits, including faster processing times and reduced paperwork. Additionally, our platform provides tracking features that keep you updated on the status of your form, giving you peace of mind during the tax filing process.

-

Is there a cost associated with using airSlate SignNow for the IRS injured spouse 8379?

Yes, airSlate SignNow offers a cost-effective subscription model that allows users to manage and sign documents, including the IRS injured spouse 8379 form. Pricing plans are designed to suit different business needs, ensuring you get the best value for your money when managing your tax-related documents.

-

Can I integrate airSlate SignNow with other tax software to manage my IRS injured spouse 8379?

Absolutely! airSlate SignNow can easily integrate with various tax software and platforms, streamlining your document management process. This integration allows you to seamlessly handle the IRS injured spouse 8379 along with other relevant tax forms, all in one place.

-

What security measures does airSlate SignNow have for handling IRS injured spouse form 8379?

airSlate SignNow takes security seriously, employing advanced encryption and secure cloud storage to protect your IRS injured spouse form 8379 and other sensitive documents. Our compliance with industry standards ensures your data remains confidential and secure throughout the signing and submission process.

-

How do I access customer support for issues related to the IRS injured spouse 8379?

If you encounter any issues while submitting your IRS injured spouse form 8379 using airSlate SignNow, our dedicated customer support team is here to help. You can signNow out via email, live chat, or phone to get the assistance you need quickly and effectively.

Get more for Form IRS 8379 Fill Online, Printable, Fillable

Find out other Form IRS 8379 Fill Online, Printable, Fillable

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe